The Company Section of the Bank Reconciliation Does Not

The company section of the bank reconciliation does not O a. If it has not yet cleared the bank by the end of the month it does not appear on the month-end bank statement and so is a reconciling item in the month-end bank reconciliation.

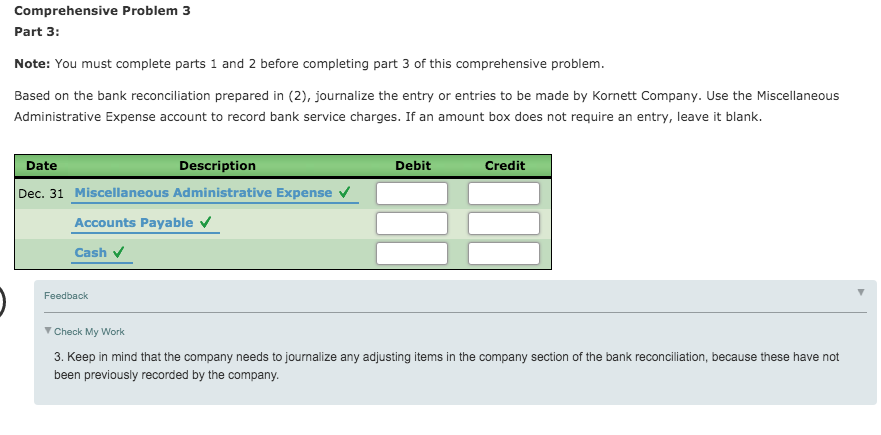

Solved Comprehensive Problem 3 Part 3 Note You Must Chegg Com

There are three steps.

. 15 16 17 18 19. Enter the cash balance at the end of the month from the bank statement. For example a deposit made in a banks night depository on May 31 would be recorded by the company on May 31 and by the bank on June 1.

The final transaction listed on the Vector Management Groups bank statement is for 18 in interest that has not been accrued so this amount is added to the right side of the following bank. Keep in mind that the company needs to journalice any adjusting items in the company section of the bank reconciliation because these have not been previously recorded by the company Petty Cash Fund Prepare journal entries for each of the following. Before you start you need to gather the following information.

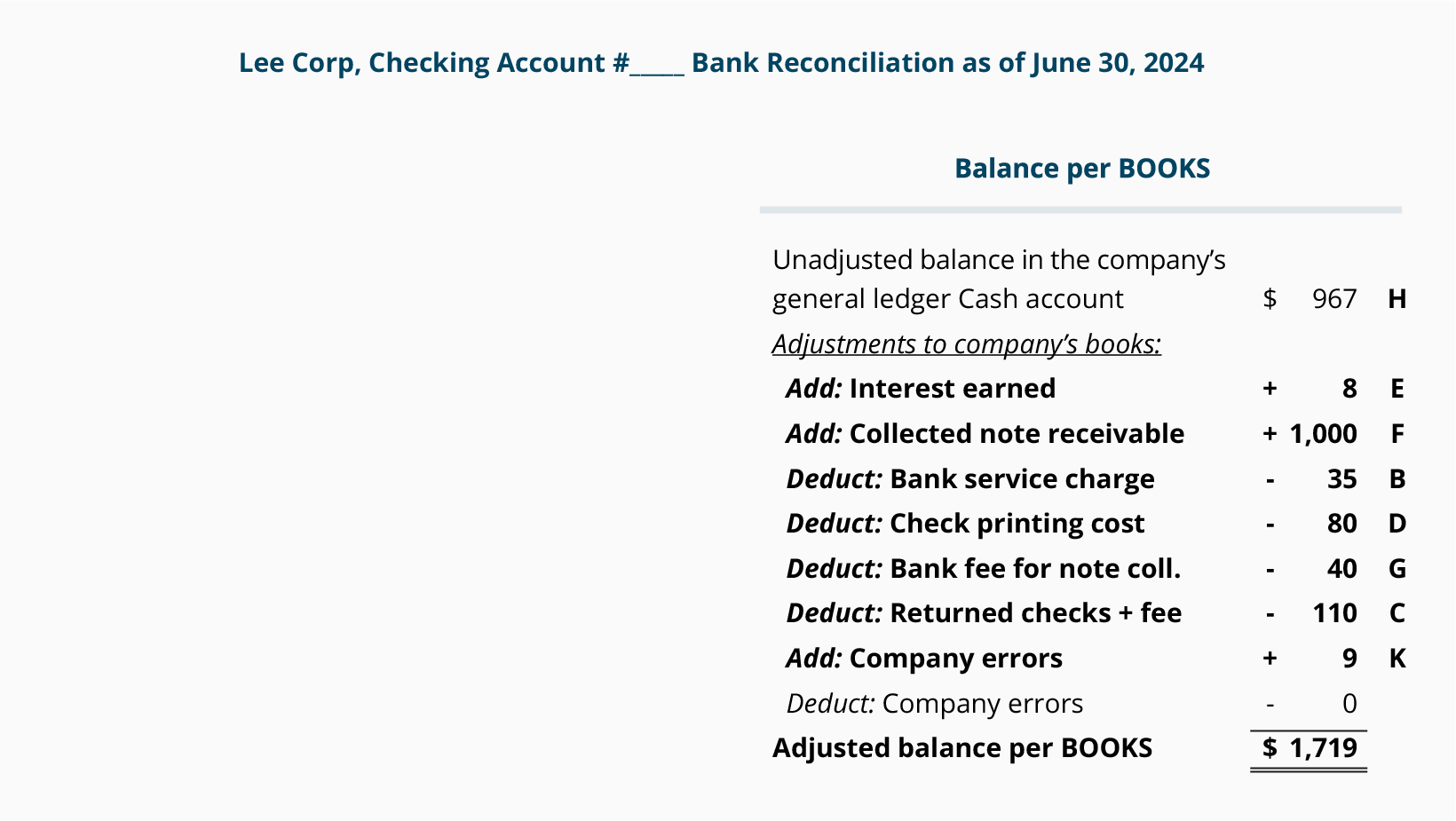

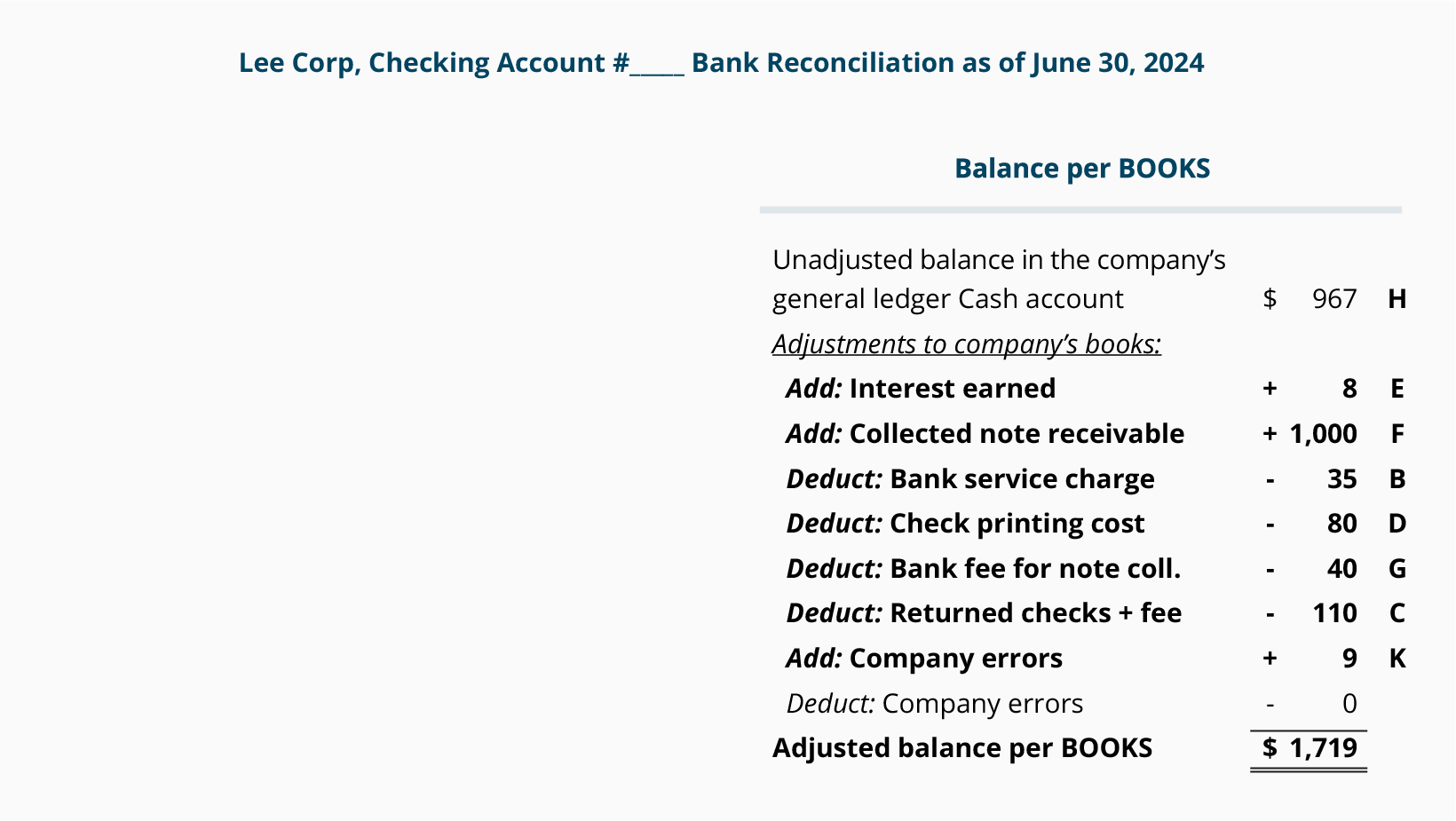

How to do bank reconciliation the bank section. Bank reconciliation example. Begin with the cash balance according to the companys records.

Issued a check to establish a petty cash fund of 500. Begin with the cash balance according to the companys records. End with the adjusted balance.

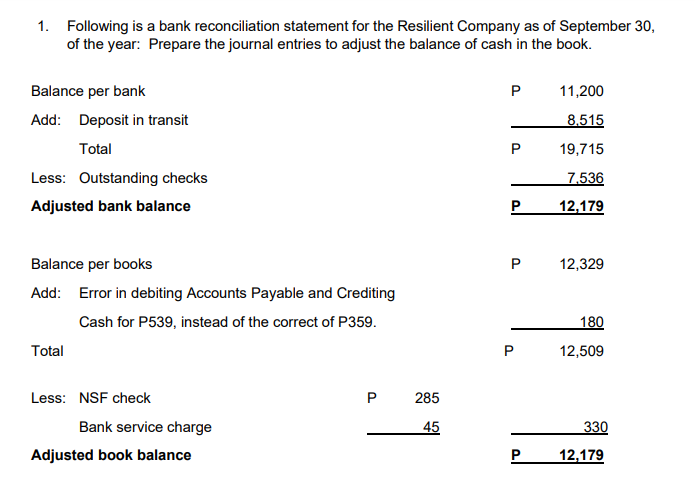

Deduct debit memos that have not been recorded. Interest income reported on the bank statement has usually not been accrued by the company and therefore must be added to the companys book balance on the bank reconciliation. The items on the bank reconciliation that require a journal entry are the items noted as adjustments to books.

End with the adjusted balance. Suppose you run a business called Gregs Popsicle Stand. You can do a bank reconciliation when you receive your statement at the end of the month or using your online banking data.

Deduct the outstanding checks unpaid by bank compared the data between statements. Bank Reconciliation Procedure. Examples of Journal Entries for Bank Reconciliation.

These are the items that appear on the bank statement but are not yet recorded in the companys general ledger accounts. Using the cash balance shown on the bank statement add back any deposits in transit. A list of transactions from the bank.

On the bank statement compare the companys list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Also check the deposits in transit listed in last months bank reconciliation against the bank statement. Comparing your statements adjusting your balances and recording the reconciliation.

You will need to get that from your online banking account a statement or have the bank send the data to your accounting. The bank reconciliation is divided into bank section and company section. Deduct debit memos that have not been recorded.

To make the process easier consider the following bank reconciliation steps. Toblem 13 of 19 The company section of the bank reconciliation does not 13 14 O a. Deduct any outstanding checks.

Journal Entries for Bank Reconciliation. Thus the deposit does not appear on a bank statement for the month ended on May 31. A check that was not honored by the bank of the entity issuing the check on the grounds that the entitys bank account does not contain sufficient funds.

Get Bank Records and Business Records. Add an unrecorded deposit using data from company statement.

Solved 1 Following Is A Bank Reconciliation Statement For Chegg Com

Bank Statement Reconciliation Template Elegant 018 Bank Reconciliation Template Excel Free Dow Student Information Sheet Student Information Statement Template

Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach

Comments

Post a Comment